The Greatest Guide To Transaction Advisory Services

Wiki Article

The Facts About Transaction Advisory Services Revealed

Table of ContentsFacts About Transaction Advisory Services RevealedNot known Factual Statements About Transaction Advisory Services Top Guidelines Of Transaction Advisory ServicesThe 2-Minute Rule for Transaction Advisory ServicesSome Known Details About Transaction Advisory Services

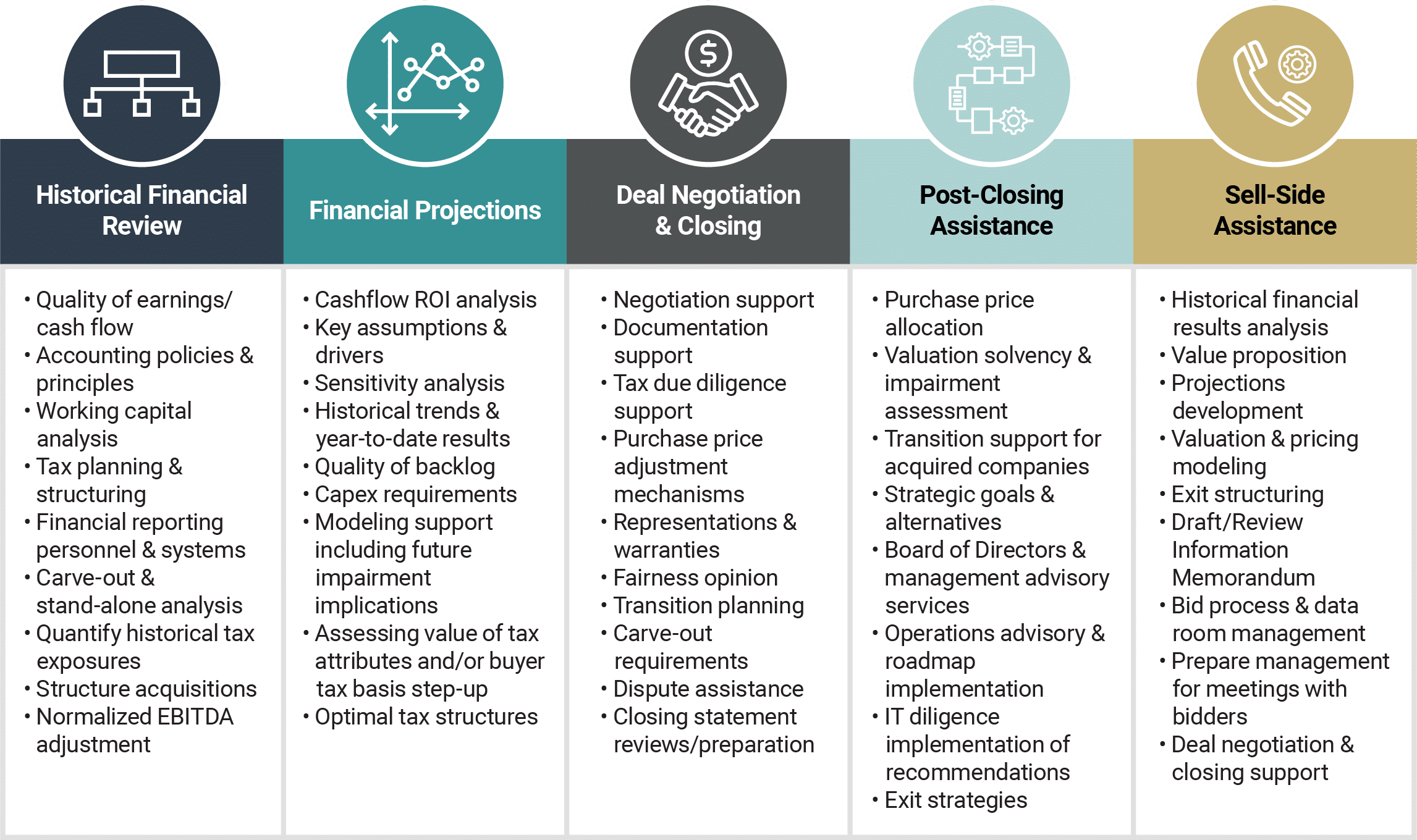

This step makes sure the service looks its ideal to potential purchasers. Getting the company's value right is important for a successful sale.Purchase experts step in to help by getting all the needed details arranged, responding to concerns from customers, and arranging sees to the business's location. Transaction advisors use their experience to help business owners deal with hard negotiations, satisfy buyer assumptions, and framework offers that match the proprietor's goals.

Fulfilling legal regulations is critical in any kind of organization sale. They aid organization owners in preparing for their following actions, whether it's retired life, starting a new venture, or handling their newly found wealth.

Transaction consultants bring a wealth of experience and understanding, making sure that every aspect of the sale is managed skillfully. With tactical prep work, valuation, and arrangement, TAS assists local business owner accomplish the greatest possible list price. By making certain legal and governing conformity and handling due diligence along with various other deal staff member, transaction advisors minimize prospective dangers and liabilities.

The Basic Principles Of Transaction Advisory Services

By comparison, Huge 4 TS teams: Deal with (e.g., when a prospective customer is conducting due diligence, or when an offer is shutting and the purchaser needs to incorporate the business and re-value the seller's Annual report). Are with costs that are not connected to the bargain shutting efficiently. Earn fees per engagement someplace in the, which is less than what investment banks gain also on "small bargains" (however the collection probability is likewise much higher).

The interview concerns are very similar to investment financial interview questions, however they'll concentrate a lot more on audit and valuation and much less on subjects like LBO modeling. As an example, expect inquiries about what the Change in Capital means, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like test balances and how to stroll with occasions making use of debits and credit reports instead of economic declaration adjustments.

Transaction Advisory Services Things To Know Before You Get This

Specialists in the TS/ FDD groups might likewise speak with administration concerning everything above, and they'll compose an in-depth report with their findings at the end of the process.The pecking order in Purchase Services varies a little bit from the ones in financial investment banking and exclusive equity professions, and the general form resembles this: The entry-level function, where you do a great deal of data and financial analysis (2 years for a promo from below). The next degree up; similar job, but you get the even more fascinating bits (3 years for a promo).

In particular, it's tough to get advertised beyond the Manager degree since few individuals leave the task at that stage, and you need to start revealing evidence of your capability to produce profits to breakthrough. Allow's start with the hours and way of living since those are easier to describe:. There are occasional late evenings and weekend job, yet nothing like the frenzied nature of financial investment financial.

There are cost-of-living modifications, so expect reduced settlement if you're in a cheaper place outside significant economic anchor (Transaction Advisory Services). For all settings other than Partner, the base salary comprises the bulk of the overall payment; the year-end bonus offer could be a max of 30% of your base income. Commonly, the most effective way to increase your profits is to switch over to a different firm and negotiate for a higher salary and reward

Unknown Facts About Transaction Advisory Services

You could enter into company advancement, but investment financial obtains harder at this stage due to the fact that you'll be over-qualified for Analyst duties. Business money is still a choice. At this stage, you try these out should just stay and make a run for a Partner-level duty. If you desire to leave, perhaps relocate to a customer and do their assessments and due persistance in-house.The main trouble is that since: You generally need to join one more Huge 4 team, such as audit, and job there for a few years and after that relocate into TS, job there for a few years and after that move right into IB. And there's still no warranty of winning this IB function due to the fact that it depends upon your region, clients, and the working with market at the time.

Longer-term, there is also some risk of and since evaluating a company's historic economic details is not exactly brain surgery. Yes, people will certainly always need to be involved, however with advanced innovation, lower headcounts can possibly support customer involvements. That said, the Purchase Providers group defeats audit in regards to pay, work, and exit chances.

If you liked this write-up, you may be thinking about reading.

The 25-Second Trick For Transaction Advisory Services

Develop sophisticated monetary frameworks that aid in establishing the actual market value of a company. Give advising work in relationship to business valuation to assist in bargaining and pricing frameworks. Explain the most ideal kind of the bargain and the sort of factor to consider to employ (money, stock, earn out, and others).

Do assimilation planning to determine the procedure, system, and business changes i loved this that might be needed after the deal. Establish guidelines for integrating departments, modern technologies, and service processes.

Analyze the possible customer base, sector verticals, and sales cycle. The operational due diligence supplies crucial insights right into the functioning of the company to be acquired worrying risk evaluation and value production.

Report this wiki page